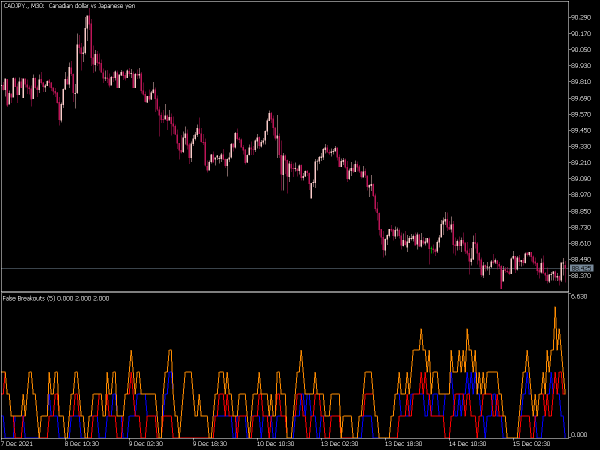

How to Detect False Breakouts Using MT5 Candle Pattern Clusters

In the sphere of technical trading, many traders struggle with false breakouts as they actively try to engage the market. Premature entries triggered by false breakouts can in most scenarios lead to losses and damage to the trader’s overall portfolio. Balancing performance while protecting assets is crucial for any trader, independent or working under a prop firm, remember to always master distinguishing true breakouts from false ones, as this skill is vital when looking to enhance overall performance. One powerful tool that can assist when enhancing pattern recognition to provide clarity in chaotic markets is candle pattern clusters on the MT5 trading platform.

The primary focus of this article is the exploration of candle pattern clusters on MT5, and how traders can use various strategies to prevent false breakouts and therefore enhance overall trading precision.

Characteristics of a False Breakout

Before going into detailing the different technical detection systems, let us first explore false breakouts and their rationale. In essence, a false breakout occurs when the market seems to be moving past an area of significant support or resistance level. Each trader is forced to put their position based on whatever the triggers which results in reverting back (whipsaw movement) into the previous lever. Expecting breakouts to be continuously active also entraps a lot of traders expecting a reversal.

False breakouts or head fakes are an occurrence that can be seen in every financial market, whether it is forex, stocks, or commodities. These breakouts are fundamentally driven by liquidity grabs, stop runs, and market maker manipulations. The dilemma is trying to determine what sentiment change is real versus what price shift intended to violently move out “weak” participants.

The Role of MT5 in Technical Pattern Analysis

The MT5 trading platform, which was developed by MetaQuotes, offered enhanced charting features and a higher level of technical analysis which drew the attention of both retail and institutional traders. In comparison to MT4, MT5 has an expanded selection of indicators, custom scripts, and timeframes, greatly improving pattern-based analysis.

*One of the core strengths of MT5 is its compatibility with custom indicators and algorithmic tools that can automatically identify candle and cluster patterns.* These tools can look through multiple charts and time frames at the same time, spotting critical reversal or continuation signals that would take hours to find manually. This capability is simply priceless to prop traders who need to make data driven decisions in extremely time constrained situations.

What Are Candle Pattern Clusters?

Candle pattern clusters refers to areas where multiple candlestick patterns overlap within set boundaries and most of the time, enhances each other’s predictive strength. In the case that a candlestick pattern exists, be it a hammer or a shooting star, it on its own may not be of much importance, especially when the market is sideways. Nonetheless, when a tight price area contains multiple reversal patterns such as engulfing candles, pin bars and inside bars, it indicates chances of a market reaction.

Tight price areas that contain reversal patterns are often formed at important support and resistance levels, Fibonacci retracement levels, or even trendlines. If identified correctly, these tight price areas can alert traders of possible reversals or continuations in the market enabling them to anticipate and prevent damage from false breakouts.

Detecting False Breakouts with Candle Pattern Clusters

When using pattern clusters of candles to detect false breakouts on the MT5 trading platform, traders need to take a methodical approach. Marking breakout zones, which are points on the price that have been tested multiple times as tops and bottoms or the points on established trend lines, is the first step. After marking these zones, the trader waits for the formation of clusters of candle patterns.

Let’s say, for example, the price breaks out above a key resistance level, and instead of any acceleration, it forms several doji candles and bearish engulfing patterns as well as long wick candles within a few bars. This cluster suggests some form of indecision and buyer’s fatigue. In this scenario, instead of participating in the breakout, the trader would wait for confirmation, in this case, a move under the resistance level which would validate the assumption that the breakout was indeed fake.

The provided MT5 charting solutions enable traders to zoom in across different timeframes, which makes spotting such clusters instantaneous and real-time. To illustrate, a false breakout can be spotted on the H1 chart but on the M15 chart, it may still show a temporary continuation.

Combining Volume with Clusters for Precision

Looking at candle patterns in isolation is insufficient. The volume is what confirms or disqualifies a breakout. On the MT5 platform, traders have the option of using volume indicators to confirm whether or not strong participation supports the breakout.

A true breakout relies on a spike in volume, suggesting there is genuine interest. A false breakout, however, might happen with low volume, particularly if the candle pattern clusters display indecision or reversal signals. A notably strong indication that the move is lacking conviction is when a bearish engulfing candle forms at a new high on weak volume.

This complex verification approach works well for traders at a prop firm, where the focus is on achieving consistent results and managing risk. The firm’s capital, as well as the trader’s capital, is protected by employing volume pattern clusters, which greatly reduce the likelihood of taking positions based on unreliable signals.

Need for Multi-Timeframe Analysis

MT5 has the added benefit of efficiently managing different timeframes. Those working from the daily or H4 chart may miss a pattern cluster that develops in a lower timeframe. On the other hand, those using lower timeframes may not identify the emerging breakout, while a daily chart pattern cluster would serve as a stronger indication that would suggest caution.

As an illustration, a trader might identify a breakout on the M30 chart. But looking at the H4 chart could show a bearish cluster developing at a resistance level from a much longer-term view. In this example, what appears to be some sort of a breakout on the lower timeframe, actually, is just a broader perspective’s view of a failed attempt to hold higher ground.

Prop traders tend to trust their multi-timeframe alignment and use it as a filter before exposing a position. Whenever different timeframes align with the same directional consensus or opposing alerts, it becomes an indication of increased probability proportional to a successful trade.

Psychological Aspects and Candle Behavior

Traders’ false breakouts take advantage of FOMO and herd mentality at the same time. A price movement which starts crossing a known borderline for many traders can appear as the IQ defining moment for others, thus, drawing them in. What traders do not realize is that smart traders scrutinize the price movement with the help of technical indicators to confirm the breakout’s authenticity.

In MT5, these subtle signals can be decoded by using visualization tools especially when the market story is foggy. These traces portray who is backing off and who is the force behind the chart candles, revealing the battle that is occurring beneath the market surface. These include wicks and indecision candles, or even back-to-back reversal patterns.

Psychological clusters often concisely signify what any indicator will fail to express. It marks the turning point for sentiments and the area where smart money either steps in or steps out.

Constructing a strategy for detecting false breakouts

In order to optimize the use of clustered candle patterns, traders should try to formulate broader encompassing strategies. Traders can devise and upload EAs to MT5, which in turn implement alert systems for falsely predicted breakouts. Such EAs search for specific clusters of patterns as well as volumes and alert the trader when all market conditions are satisfied.

Documenting an edge is a necessity for prop traders. EAs assist them in pattern-clustering false breakouts which is an essential building block to any algorithmic rule-based strategy. Such integrated approaches enhance the deterministic nature of discretionary trading, which, in turn, reduces reliance on the trader’s judgment during time-sensitive situations.

MT5 allows users to formulate, test, and refine algorithms through backtesting. By evaluating the ability of clustered patterns to predict reversals after false breakouts, traders can further optimize the strategy designed to enhance trader confidence.

Conclusion: Transform Market Noise into a Signal

It’s not about having a crystal ball to know when false breakouts occur; it’s about interpreting the market. With the advanced technical features and real-time functionalities of the MT5 trading platform, spotting these signals has never been easier, particularly when they manifest as clusters of candle patterns.

Strategic traders and those employed in prop firms greatly benefit from acquiring this skill. It mitigates emotional responses to trading, cuts out poor quality setups, and provides a structured method to interact with the markets.

While false breakouts may always exist, proficient traders can reverse these market traps into profitable opportunities through solid tools and clever recognition of patterns.